According to the report released by SolarPower Europe(SPE), after the global photovoltaic installation growth rate dropped by more than 50% in 2024, the market will continue to slow down in 2025.

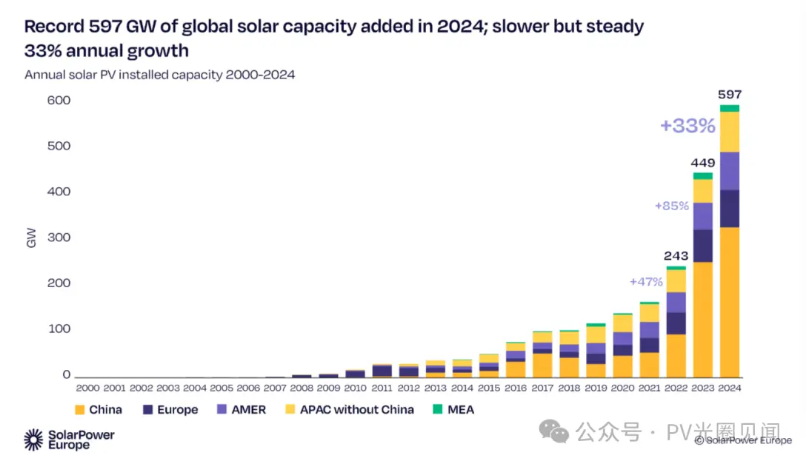

According to the report, the global installed capacity of solar photovoltaic power reached a new high of 597GW in 2024, an increase of 33% compared with 2023.

Although the annual growth rate in 2024 has slowed down compared with the astonishing growth rate of 85% in 2023, this growth rate is still considerable, further consolidating solar energy's leading position in the global expansion of renewable energy.

New TOP10 countries

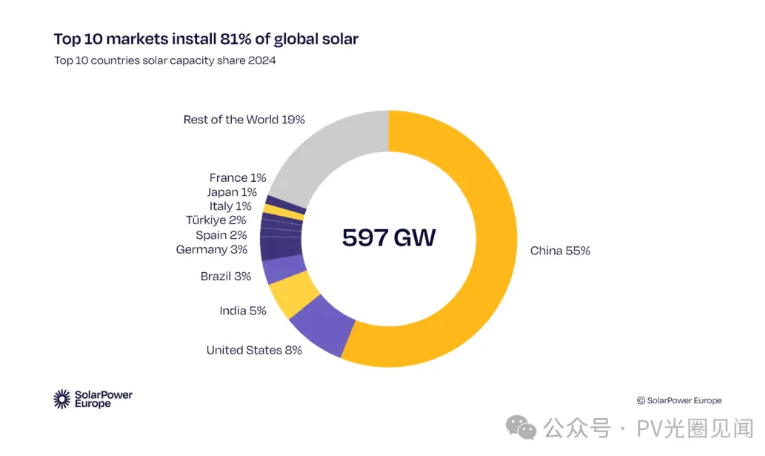

Türkiye: the annual installed capacity increased by 5 times to 8.5GW, ranking 7th in the world;

France: Growth rate of 49% reached 4.7GW, ranking 10th among the top ten;

Spain (8.7GW), Italy (6.8GW), and Japan (6.2GW) ranked 6th, 8th, and 9th respectively.

Increased market concentration

The top ten countries account for 81% of the world's newly installed capacity (totaling 116GW), while other regions only account for 19%, highlighting regional development imbalances.

Trends and Challenges in 2025

Significant slowdown in growth rate

Global new installed capacity is expected to increase by only 10% (33% in 2024 and 87% in 2023), mainly due to geopolitical conflicts, trade barriers, and economic stagnation.

China's photovoltaic overcapacity (1.2TW capacity vs 600GW annual installed capacity) remains low, but the industry has entered a period of adjustment.

Regional differentiation intensifies

Europe ranks last: with a growth rate of only 3%, major markets such as Germany and Spain have stagnated due to power grid bottlenecks and weak household consumption;

Turning point in the United States: Policy uncertainty may lead to a mid-term recession, with growth rate dropping to 2.5% by 2025;

Asia Pacific led:

China accounts for 53% of global installed capacity (with growth slowing down to 6%);

India's growth is 21%, with the government bidding for 73GW projects to support expansion.

Central and South America are stabilizing: Chile increased by 15%, while Brazil and Mexico saw a sharp decline in growth rates.

Core contradiction

Insufficient flexibility of the power grid and lagging policy frameworks lead to "artificial saturation";

The strengthening of fossil fuel lobbying and the impact of geopolitical risks on industry stability.

Key conclusions

Global imbalances to be resolved: G20 and developing countries need to accelerate the popularization of photovoltaics to bridge the gap;

Transition Pain Period: The industry shifts from the "price crisis driven outbreak period" to the "policy and technology driven refined competition stage", and systematic reforms (power grid upgrading, flexibility mechanism) become the key to breaking through.

Hot News

Hot News2025-05-12

2025-04-30

2024-05-21

2024-02-02

2024-02-02

2024-02-02